The West is lagging behind in the development of ‘superapps’ such as China’s AliPay and WeChat, which have seen widespread adoption over the past two decades. India and China lead the use of mobile wallets, which has provided a mobile payments ecosystem essential for the creation of superapps.

A superapp can be defined as a single mobile platform that incorporates a confluence of functions for the business, social and domestic daily needs of a user. Superapps include anything from social media activity, ecommerce, banking, product delivery, transport, peer-to-peer transfers and transport all meshed into one mobile platform.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

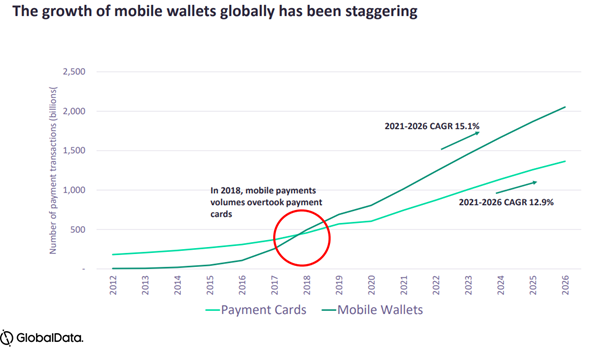

Branded mobile wallet services are the first step towards the development of full-scale superapps, according to Sam Murrant, GlobalData consultant director for financial services. He said: “2018 was the year that volumes of global mobile payments exceeded card payments.”

According to GlobalData, mobile payment volumes will continue to outstrip the growth of payment cards globally, but the growth is not evenly spread among geographies. Western economies have suffered from inertia when it comes to a mobile-first payments environment, according to Murrant. The persistent use of traditional electronic payment tools such as payment cards, which have been around for a couple of decades, and cash, which has been around much longer in terms of market penetration, are reasons why the superapp has, so far, eluded companies in the West.

The rise of social media companies in the West and their aggressive efforts to monetise their platforms through social commerce represents an opportunity for the development of the superapp. Social commerce (considered a subset of existing ecommerce) is essentially a shift towards in-app mobile payments. Companies such as Meta have the kind of monthly active user base that gives them huge potential to integrate commerce and move towards becoming a superapp, according to Murrant. “Facebook, for example, has three billion monthly active users – as more services get rolled out we are moving towards a super app environment,” he added.

While social media companies have the potential to enter the superapp space, Murrant cited the growing sentiment among policymakers to crack down on antitrust practices as a significant challenge to this ambition. According to Murrant, Western companies would only achieve Superapp status through acquisitions and partnerships at scale “that would be difficult to achieve because they would come up against antitrust laws”.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCompanies like Amazon benefit from existing partnerships in payments and some booking functionality, “but they are still not Superapps”, says Murrant. Founded in 1998, Paypal is the oldest of a slew of companies with potential for Superapp development. Murrant cites the company’s impressive global user base of 498 million and its diverse service offering as having the potential to develop into a Superapp. “Paypal is probably one of the closest to becoming a superapp if it could integrate some of the functionality, which would take it beyond payments,” he says.

Essentially, the development of superapps would require strategic acquisitions by existing platforms such as PayPal, Meta and Facebook at a time when the US Federal Trade Commission’s targeting of Big Tech antitrust practices is intensifying.

Two high-profile cases in particular have demonstrated the US government’s commitment to face down Big Tech acquisitions. Microsoft’s acquisition of game developer Activision came under antitrust scrutiny by the Federal Trade Commission in December 2022 and Google underwent similar investigations aimed at a forced divesture of parts of its advertising business.

The European Commission is leading the charge in targeting Big Tech with its increased focus on antitrust regulation over the past two decades, culminating in its Digital Markets Act and Digital Services Act, which came into force in November 2022.