A global semiconductor supply chain crisis, prompted by the Covid-19 pandemic, brought the world’s dependence on the products into stark relief. Everything from computers and mobile phones to refrigerators and cars rely on semiconductors as essential electrical components of many of today’s ubiquitous products.

A geographic monopoly of the design and manufacture of semiconductors, specifically in Taiwan and South Korea, has prompted governments and companies alike to re-evaluate supply chains and manufacturing locations. Significant shifts in announced foreign direct investment (FDI) projects are expected for 2022.

Our FDI project database tracked semiconductor inward investment throughout 2019 and 2020 and found that there were no surprises in the highest-ranking countries in terms of new cross-border semiconductor project numbers. China attracted the highest number of projects, followed by Germany, the US, India and Taiwan.

However, all top five destinations saw a decline in new FDI projects between 2019 and 2020. This was reflected in the overall number of new FDI semiconductor projects globally, which went from 132 in 2019 to 94 in 2020, a 28.8% decrease.

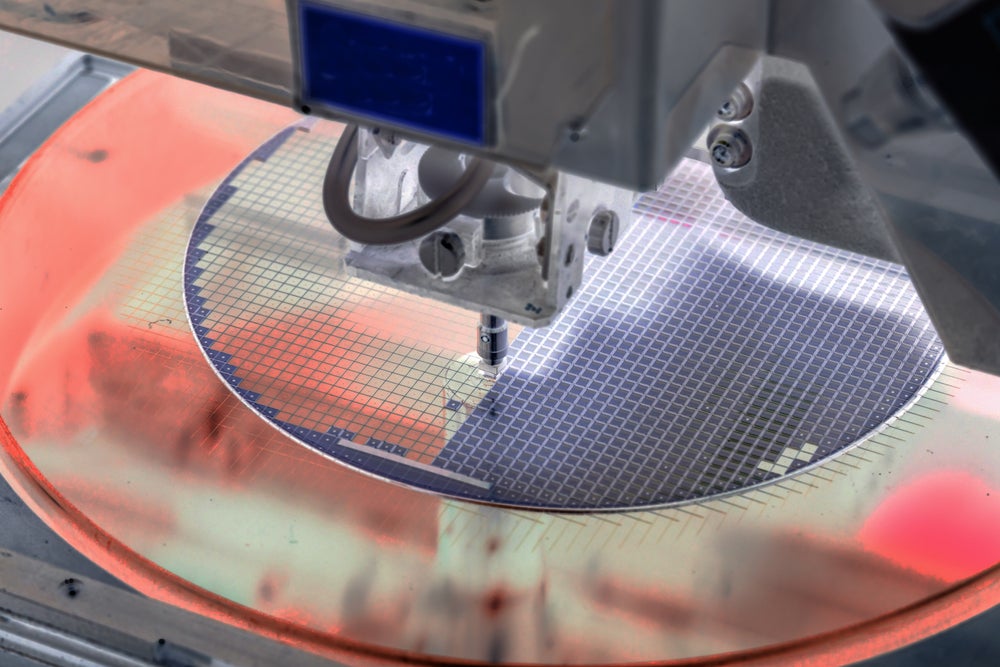

On average, a semiconductor fabrication plant (fab) requires at least two years to design and build before it becomes operational. That said, the projects that were announced, had ground broken or became operational in 2019–20 show a pattern of global diversification to address the supply chain squeeze experienced throughout the pandemic.

Locations with significantly lower project volumes but greater growth in FDI semiconductor projects show a pattern of investment throughout the Asia-Pacific region, close to but not including South Korea or Taiwan. Although these locations show minimal project numbers of fewer than ten projects, the growth is worth noting. Australia saw a threefold increase in semiconductor FDI projects between 2019 and 2020, Malaysia saw a 250% increase and Vietnam 166%. Hungary, Canada, France, Mexico and Singapore also saw increases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn March 2022, former Australian Prime Minister Scott Morrison listed semiconductors among the seven industry sectors for which Australia needs to address supply chain problems. In 2019, Norway-based Semiconductor ASA established a sales and marketing office in Sydney and Netherlands-based Altum RF established a research and development (R&D) facility in the city.

Top semiconductor FDI functions

The top business functions in semiconductor FDI are manufacturing, sales and marketing and R&D. According to our FDI Projects Database, there were a 125 new semiconductor manufacturing projects announced across 2019 and 2020, with 71 in 2019 and 54 in 2020.

Semiconductor fabs are a good source of greenfield investment, driving significant job growth. For example, in June 2022, US electronic manufacturing company Jabil announced plans to invest $400m in a new semiconductor plant in Jalisco, Mexico, creating 6,000 jobs. Intel has also announced a $700m investment in an assembly plant in Penang, Malaysia, which will create 4,000 new jobs when it becomes operational in 2024, in addition to 5,000 construction jobs.

Which countries are investing abroad in semiconductors?

Source country investment in semiconductors continued to be dominated by the US across 2019 and 2020, with 92 projects in this period. The second-largest volume of projects was funded by Germany at 30 projects, Japan at 29 projects, France at 23 projects and Taiwan at 18. Investment from all the top five source countries dropped between 2019 and 2020, with Germany seeing the largest percentage decline at 63%, followed by France with 35.7% and the US with 29.6%.

The US is set to continue to lead investment in semiconductors around the world in a bid to mitigate future supply chain problems. In March 2022, Intel pledged an $81.5bn investment in the EU’s semiconductor supply chain over the forthcoming decade. This will include functions such as R&D, manufacturing and packaging technologies. The move includes a $17.3bn investment in a new semiconductor mega-fab in Germany, a new R&D facility in France, and manufacturing and foundry functions in Ireland, Italy, Poland and Spain.

While our FDI Projects Database found that the Asia-Pacific region received the most inward investment in semiconductors across 2019 and 2020, western Europe was close on its heels. Asia-Pacific had 129 projects during this period, followed by western Europe’s 88. However, Asia-Pacific saw a bigger decline in project numbers between 2019 and 2020, from 76 to 53, compared with western Europe’s decline from 47 to 41 projects.

Despite the declines in project numbers between 2019 and 2020, semiconductors are the nucleus for many key emerging business themes, according to Investment Monitor chief economist Glenn Barklie, who believes the demand for semiconductors will continue to rise.

"Project numbers for 2021 are expected to be about 52% higher than those recorded in 2020," he says. "Although 2022 will be a difficult year for most sectors due to prolonged supply chain issues, FDI in semiconductors will witness sustained growth in the long term."

It remains to be seen (when data becomes available) how this growth will manifest in terms of global investment patterns, although geographic diversification of investment is the one thing that is assured.