The UN Conference on Trade and Development’s 2019 World Investment Report estimated that between 2014 and 2018, the number of special economic zones (SEZs) worldwide increased by 26% to around 5,400. More than 140 countries, which include almost 75% of all developing economies and almost all transitioning economies, are home to some form of zone. In addition, more than 500 zones are currently in the pipeline – either being developed or developed but not yet operational.

The type of zones and the objectives that a government would like to achieve through the zones depend on the state of the respective country’s economy. Many traditional SEZs – especially in China – focused on attracting FDI for export-led manufacturing activities and provided logistical support and incentives in the form of export and import duty exemptions. Today, there is a diverse landscape of SEZs around the world. However, most SEZs still focus on trade, logistics and inward FDI, with a few exceptions. In the United Arab Emirates, for instance, SEZs have been fundamental in the transition and diversification of the economy.

The changing role of SEZs

In recent years, two events have shifted the SEZ landscape. First was the Covid-19 pandemic, and the further intensification of protectionism and regional trade blocks, which will collectively affect the volume of investment directed towards economic zones. Second was the World Trade Organisation’s Agreement on Subsidies and Countervailing Measures, which has been designed to phase out incentives on export performance and the use of local contents. In addition, recent G7-led discussions about a minimum corporate income tax of 15% will limit the options for SEZs to differentiate themselves by providing fiscal incentives.

In summary, the classical foundation upon which the competitiveness of SEZs rests – the combination of a (tax) incentive package and a real estate solution for investors – has become obsolete. More and more, free zones award a standardised package of incentives that consists of a corporate income tax holiday in combination with preferential import and export duty treatment and other tax exemptions.

When striving to diversify their business environment and create unique competitive advantages, SEZs need to move away from overgenerous fiscal incentives that exclusively focus on increasing profit margins. These low-cost and low-tax business environment strategies are easy to copy and replicate and do not equip free zones with a distinctive source of competitiveness.

SEZs should start to rethink the role they can play in rapidly changing global value chains, focusing more on providing new investor services rather than incentives that only aim to attract FDI to new emerging activities and industries that have become the drivers of economic globalisation, as well as thinking about sustainable FDI, FDI in industry 4.0 (otherwise known as FDI 4.0, as explained in my previous article on this topic) and FDI in the digital economy, or more broadly FDI in the service sector in general. The requirements of investors in these new emerging sectors and activities are fundamentally different to the traditional manufacturing companies exploring low wages, export platforms and a generous incentive package in combination with a real estate solution.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEconomic zones of the future should become more sustainable, digitise themselves and offer the advantages of being well-equipped industrial or techno parks that can facilitate the development of competitive clusters. Zones should also be integrated in national economies and they should better showcase the economic benefits they can offer an economy. Rather than being an enclave for safe havens and competitive business environments, SEZs should become catalysts for the economic development of countries, for their diversification, and they should play a pioneering role in experimenting with and limiting regulation and administrative burdens for future investors.

NxtZones: an SEZ of the future

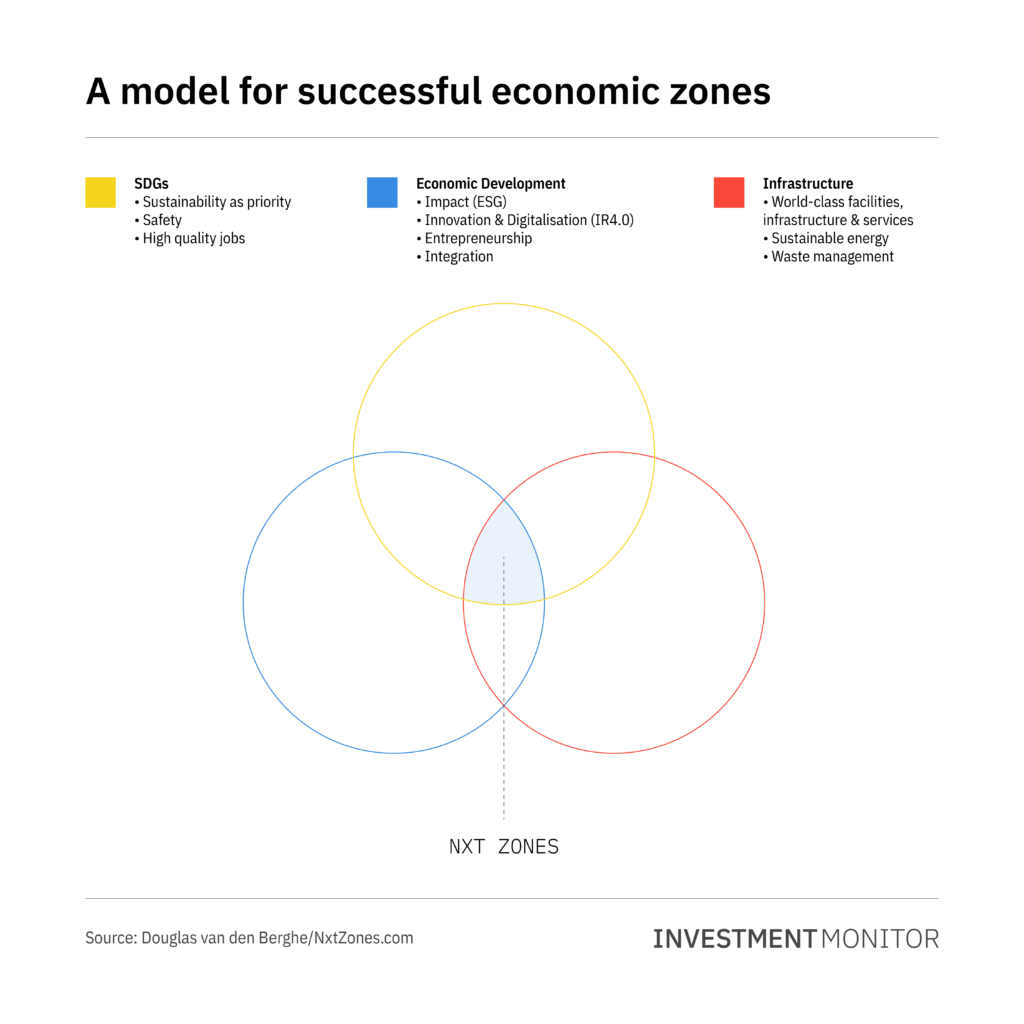

We have developed a future model, NxtZones, based upon which economic zones should develop or existing zones should transition towards in order to become more resilient and play a leading role in the transformations many countries are looking to achieve, as well as solving some of the pressing economic challenges the global economy faces. The model is presented below.

The model shows the ‘sweet spot’ where zones of the future should ideally be positioned and operate. It is at the interface of the following three dimensions: the UN Sustainable Development Goals, high-class infrastructure and services, and aiming to have the highest possible economic development impact.

In forthcoming articles in Investment Monitor, I will discuss and feature some of the existing zones that address one or multiple dimensions of the NxtZones model and examine how they do this.