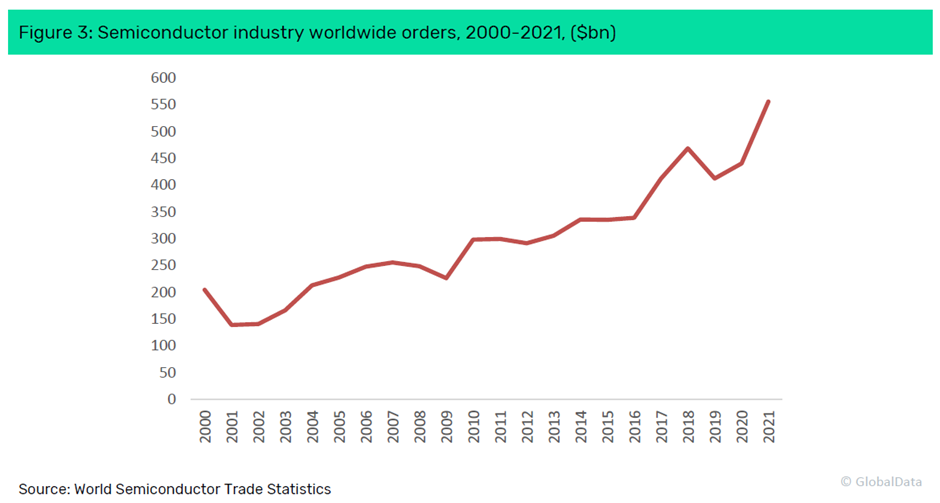

A shortage of semiconductors has been one of the main supply chain challenges for manufacturers worldwide recently and chips are at the heart of a lot of the technological innovation under way today, including emerging technologies with the potential to transform the value chains of many industries.

A dramatic shortage of semiconductors was one of the biggest global disruptions triggered by the Covid-19 pandemic. As more countries locked down — forcing consumers to stay at home and factories to sit idle — automakers, in particular, cancelled their chips orders with suppliers to reduce their costs. Chipmakers — also known as ‘foundries’ — pivoted to supplying industries, including personal electronics, where demand remained stable but, when automakers’ demand for chips started to pick up again as the pandemic drew to an end, there was a big shortage.

The semiconductor market is quite concentrated, with only a handful of incumbent producers. Semiconductor devices are manufactured in a wafer fabrication plant, otherwise known as a ‘fab’. A plant capable of producing the most advanced semiconductors requires a significant initial investment, although less advanced chips are suitable for less cutting-edge devices. The most advanced chips today are three-nanometres in size but most computer chips powering devices use ten-nanometer or seven-nanometer process technology. Moore’s Law — the prediction that the number of transistors on a silicon chip doubles every year — is in the process of breaking down as suppliers struggle to add more transistors year-on-year.

Taiwan Semiconductor Manufacturing Corporation (TSMC) is the undisputed global foundry leader, with an estimated 50% of worldwide chipmakers’ revenue, followed by South Korea’s Samsung and the US-based Global Foundries, with estimated shares of around 20% and 10%, respectively, according to GlobalData. Other important American chipmakers include Intel and Qualcomm. Semiconductor Manufacturing International Corporation (SMIC) is the biggest Chinese foundry.

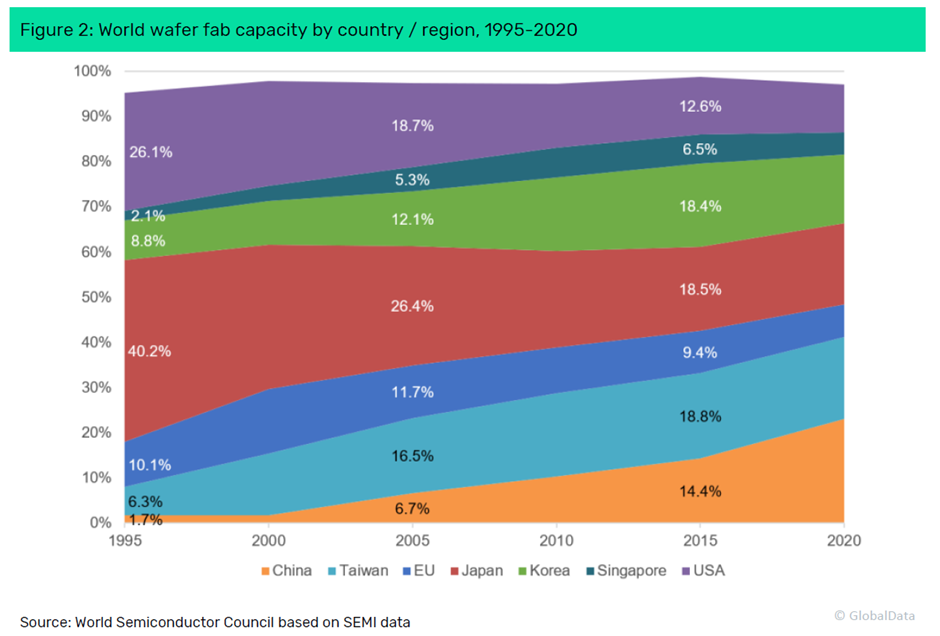

The US is concerned about its dependence on semiconductors manufactured in Taiwan, which accounts for 20% of global wafer fabrication capacity and 92% capacity of advanced chips. In December 2022, TSMC inaugurated a new fab in Arizona — it plans to triple its investment in the state to $40bn and open a second fab by 2026, which will make three-nanometre chips.

Shift to localised semiconductor supply lines

Globally, a shift to more localised semiconductors supply chains is under way — boosted by Covid-19 and the war in Ukraine. Governments want critical tech made in safer places, closer to home. The US has been a key source of chips for China in recent years — weakening the threat of new entrants in that market, which would have to compete with advanced American foundries. However, in 2019, the US and China engaged in a trade war, which resulted in tariffs being introduced. This dispute has encouraged China to become increasingly self-sufficient in producing its own semiconductors and high-end chips. The country is pouring $50bn into chipmaking, hoping to meet 70% of domestic demand for semiconductors by 2025.

The US is also trying to stop China getting advanced chips. It passed the Chips and Science Act in August 2022, offering $39bn in subsidies and a 25% tax credit to promote manufacturing at home, as well as $13bn of investment in semiconductors research. In October 2022, it banned the export of advanced chips and chipmaking gear to China.

In its Global Semiconductors Market Supply Chain Analysis report, published in June 2023, GlobalData says: “Taiwan has been exceptionally successful in establishing a strong presence in the semiconductors market. Despite its much smaller geographic and demographic size, its market is valued at more than two times that of the US semiconductors market. Growth has been boosted by its proximity to China, where strong demand has resulted in Taiwanese companies exporting large quantities of semiconductors.”

In the report, The Cold Tech War and the Semiconductor Industry: What Next?, published in November 2022, Beatriz Valle, senior technology analyst at GlobalData, says: “For the time being, the tug of war over semiconductors, and especially between the US and China, continues unabated. This has put Taiwanese TSMC in a tricky position. China’s political stance towards Taiwan — which has been growing increasingly aggressive in the last 12 months — means the company seeks to be in good terms with Washington while continuing to build relationships in every international market, a delicate balancing act.”

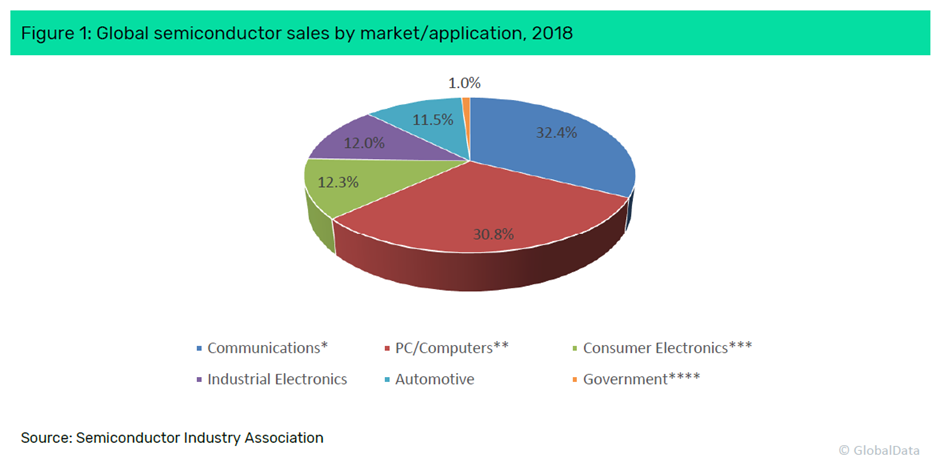

The main buyers in the semiconductors market are the makers of electronic products — computer and network hardware, defence systems, industrial controls, cars, planes and consumer electronics. Buyers range in size from large multinationals with their own manufacturing facilities to smaller original equipment manufacturers.

Chips are crucial for the future

Chips are at the heart of many of new technologies being developed in the world today. Emerging technologies — including artificial intelligence (AI), 5G, autonomous driving, electric vehicles, biometric recognition, the Internet of Things (IoT) and ‘edge’ computing — are driving the demand for semiconductors. Automation, electrification, digital connectivity and cyber security have created a surge in demand for various semiconductor devices in cars, in particular, including microcontrollers, sensors and memory. Furthermore, AI and virtual reality (VR) will become a lot more common in the future, helping to fuel the demand for chips.

According to GlobalData, the global AI industry reached a value of $58.8bn in 2020 but it is forecasted to surge to $241bn by 2025. AI start-ups have been attracting an increasing amount of investment, with total global corporate AI investment amounting to $67.9bn in 2020.

In its Global Semiconductors Market Supply Chain Analysis report, GlobalData says: “Future demand for semiconductors will be boosted by the continued growth in AI and VR — solutions increasingly are being utilised by devices as diverse as smartphones, gaming consoles, and even coffee machines. The reason for this is the fact that players in this market manufacture microchips integral to the smooth running of AI and VR. VR is being integrated into gaming consoles and smartphones.”

AI’s role in chip manufacturing

Industry 4.0 also has the potential to transform the global semiconductors supply chain itself. It conceptualises the rapid transformation of technology, industries, and societal patterns and processes in the 21st Century on the back of increasing inter-connectivity and smart automation. It relates to the trend towards automation and data exchange in manufacturing technologies and processes, including cyber-physical systems (CPS), IoT, industrial internet of things, machine learning, cloud computing, cognitive computing and AI. A CPS or intelligent system is a computer system in which a mechanism is controlled or monitored by computer-based algorithms.

These emerging technologies will have a huge impact on semiconductor design and production, for instance, largely because the amount of data processed and stored by AI applications is massive. Architectural improvements in chips are needed to address data use in AI-integrated circuits. Improvements in chip design will centre on speeding up the movement of data in and out of memory, with increased power and more efficient memory systems. One option is the design of semiconductors for AI neural networks that perform more like human brain synapses. Instead of sending constant signals, they would ‘fire’ and send data only when needed.

Chips will be used to improve the efficiency of the semiconductors value chain. AI chips could include graphics processing units, field programmable gate arrays and application-specific integrated circuits dedicated to AI.

Moreover, AI will help foundries to produce supply forecasts, to optimise their inventory and to schedule deliveries. In every step of the semiconductor value chain there are time-consuming tasks that AI and machine learning could undertake. At the sales stage, AI could help with customer segmentation and dynamic pricing. Furthermore, it could help prevent errors in the manufacturing process and advance the intelligence of the integrated circuits (ICs) and the chips that are manufactured.

Increasingly, chipmakers will have digital fabs centred around efficiency and customisation. Efficiency needs to be measured in the context of increased demand for highly-customised products. In other words, companies need the agility to efficiently accommodate customer requirements at the production stage. This requires digital capabilities that support independent process controls and ‘intelligent’ shop floor guidance.

China is the world’s biggest consumer of semiconductors responsible for over 40% of global consumption, according to GlobalData. The country is also leading the way in terms of AI research. Huawei’s EMUI 8 chip enables smartphones to understand the behaviour of users at a more advanced level than other chips on the market.

The Taiwanese government has also allocated more than $500m for the development of an AI innovation ecosystem. Of this, $132m will be spent on the IC segment for use in the AI industry.

In January 2023, at the World Economic Forum in Davos, Switzerland, Sultan Ahmed Bin Sulayem, DP World group chairman and chief executive officer, talked about the way in which globalisation is changing as companies are forced to adapt to new challenges. “By bringing production closer to the final customer, firms can reduce the number of touch points involved in the supply chain and build greater resilience into the flow of cargo around the world,” he said. “But the trade environment is always changing. The next challenge that will alter these trends is an economic slowdown looming over regional markets. Agility, real-time visibility and end-to-end supply chain capabilities will be critical to ensuring companies can continue to find new efficiencies in an increasingly challenging environment.”

Mounting geopolitical risk is forcing governments to create more localised semiconductors supply chains. Chips are absolutely vital to many emerging technologies being developed around the world, including virtual reality. The global semiconductors value chain itself is also leveraging AI and machine learning to create a more efficient supply chain of the future.