Wide-reaching Covid-19 lockdown orders enacted in Shanghai in April 2022 have now been extended, signalling further disruption for automotive players operating in the city.

The move comes in response to the city’s infection rate remaining stubbornly high from the Omicron variant and China’s wider commitment to its ‘zero-Covid’ policy. Current indicators suggest that the lockdown has seen factory activity in the city slump to its lowest level for two years, since the pandemic began.

Why Shanghai extended its lockdown

The city had enacted its original lockdown plan in two phases. Initially, the restrictions would be applied to areas to the east of Shanghai’s Huangpu River, where most of its factories are located. The expectation was that, from Friday 1 April, the lockdown to the east of the river would lift and be shifted over to areas west of the river. However, with infections failing to come down, the eastern lockdown was extended. This, combined with the now-locked-down western half of the city, means Shanghai is effectively under full lockdown restrictions.

Already, electric vehicle giant Tesla had extended its planned shutdown of its Shanghai gigafactory through to 2 April, but it’s very likely that further shutdown extensions may be needed if the city remains under restrictions. In early April it was reported that the plant has been unable to restart. Similarly, Volkswagen’s joint venture with SAIC has been forced to close a portion of its Shanghai factory in response to difficulty in securing parts supplies. General Motors is also active in the city but has managed to keep its production lines moving by asking workers to literally sleep on the factory floor to maintain a ‘closed-loop’ facility as instructed by local authorities.

Shutdowns in the city have also affected auto suppliers including Aptiv and ThyssenKrupp, which have both instructed workers to go home. Bosch has two plants in Shanghai, with both currently operating at reduced staffing levels. Toyota’s heavy truck division, Hino Motors, also operates an engine plant in Shanghai, which has been forced to pause production in response to lockdown orders. A key difficulty most of these companies are encountering is not just the risk that their factory might be instructed to shut or that they cannot receive parts deliveries but, even if they can physically open the doors, their workers may not be able to leave their residential buildings as lockdown orders evolve.

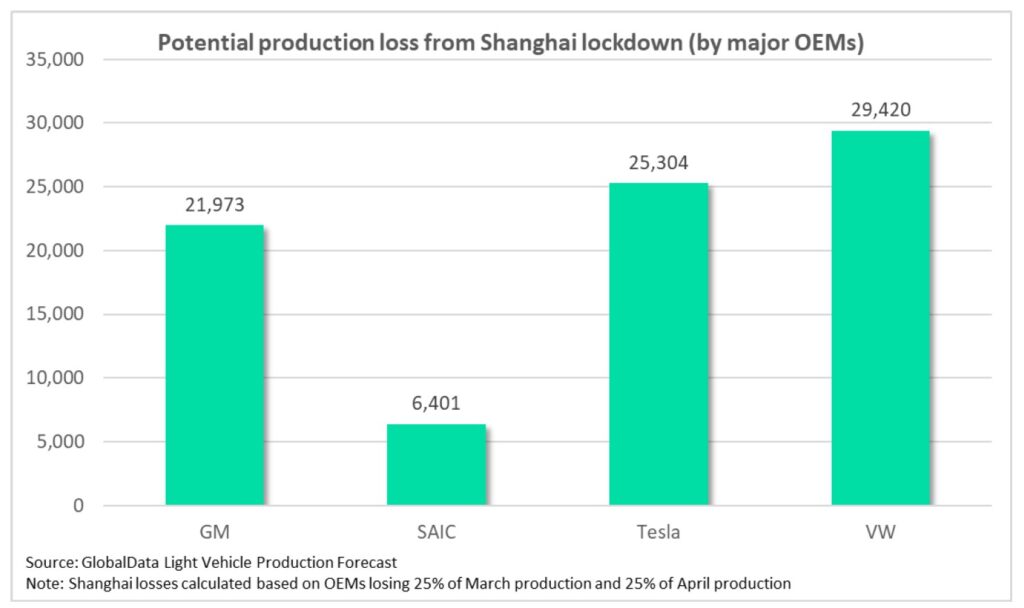

GlobalData’s Light Vehicle Production Forecast, generated prior to the lockdown extension, shows that production in Shanghai* for March 2022 was expected to reach about 172,000 units. With most of the city’s main automakers planning at least one full week of stoppages, it’s likely that around a quarter of that total – roughly 43,000 units of production – will be lost. Hypothetically, if the shutdown also continues into the first week of April, that could cost an additional 40,100 units, bringing the total loss over the course of the Shanghai shutdown to 83,100.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFour key auto groups account for the overwhelming majority of light vehicle production in Shanghai:

- GM builds a range of Buick and Cadillac models for local sale, with pre-lockdown forecasts expecting around 46,000 units of production March 2022

- SAIC produces a number of MG and Roewe-branded vehicles, with pre-lockdown forecasts for March 2022 suggesting it would build around 13,400 units

- VW’s JV with SAIC builds a variety of Audi, Skoda and VW models – pre-lockdown forecasts for March 2022 put VW-SAIC production at around 62,000 units

- Tesla’s largest factory by volume is its Shanghai operation, which makes Model 3 and Model Y vehicles. Pre-lockdown forecasts suggest it would have built 50,600 units without the impact of COVID restrictions

In the short term, most automakers in Shanghai are expected to continue cutting production estimates as the movement of parts and factory workers in the city remains restricted. However, China’s authoritarian ability to firmly enact and enforce wide-reaching lockdown orders means it does has a reasonable chance of stamping out the current infection wave more quickly than some comparable western nations might achieve in a similar scenario.

*’Shanghai’ here refers to a circular area with a 30km radius around the city centre.

This article initially appeared in Just Auto.