Four out of five start-ups risk failure in 2023 in the biggest mass extinction of early-stage ventures since the 2008 financial crisis. According to research by January Ventures, 81% of early-stage start-ups stated they only have less than 12 months of runway left (termed as “enough capital to keep the lights on”). Between August and October 2022, the study surveyed 450 early-stage start-up founders mostly from the US (61%) and Europe (32%).

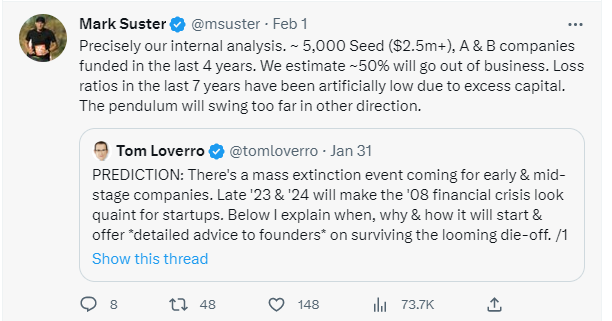

In Twitter post on 1 February 2023, venture capitalist Mark Suster confirmed that the January Venture findings rang true with internal analysis from Upfront Ventures, the Los Angeles-based venture capital (VC) firm for which Suster is a partner. He estimates that of the 5,000 early-stage companies Upfront Ventures had funded over the past four years, half were at risk of going out of business. He added that the number of start-up failures had been held artificially low over the past seven years due to the market being flooded with excess capital.

In the same thread Tom Loverro, a venture capitalist at Silicon Valley-based investment firm IVP, predicted a “mass extinction event coming for early and mid-stage companies” which would make late 2023–24 look even worse than the 2008 financial crisis for start-ups.

The gloomy prediction for the state of the start-up sector aligns with a massive drop in global venture financing throughout 2022. According to GlobalData, the value of global VC dropped by 36% in 2022. In 2021, the value of global VC deals was $512.7bn compared with $293.8bn in 2020.

While the overall value of VC deals dropped by more than one-third in 2022, deal volume appears to have remained relatively steady, according to GlobalData.

In 2021, there were 21,773 VC deals recorded by GlobalData, compared with 19,255 in 2022, all of which indicates a prevalence of bigger deal sizes in 2022 with far less small funding rounds for early-stage ventures.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn GlobalData’s webinar, Analysing M&A and VC Activity in Q4 2022, held on 24 January 2023, analyst Divya Dubey revealed that VC activity had dropped for a fourth straight quarter in the final quarter of 2022. Dubey cited the global economic slowdown, the ongoing Russian invasion of Ukraine, high inflation rates, rapidly rising interest rates, soaring energy prices, the looming threat of a global recession and supply chain disruption as reasons behind negative investor sentiment.

According to Dubey, all venture deal stages took a hit in the fourth quarter of 2022. Although the volume of start-up deals dropped 9% in the fourth quarter of 2022, growth stage deals took the biggest hit with a 24% drop in deal volume. More positively, Dubey predicted that VC activity would definitely increase from the lows of 2022, although it would be unlikely to match the highs of 2021. “It will be somewhere in-between,” said Dubey, with “much depending on the easing of the Russia-Ukraine war and sanctions." Dubey added that VC activity is unlikely to increase by more than 10–15% in 2023.