Ollie Brown is a GlobalData economist focusing on the construction sector and foreign direct investment in the LATAM region.

Evidently for constructors and investors on either side of the US-Mexico border, US President Donald Trump’s tariffs are rewriting international trade relations with many implications across Latin American economies. Short-term, 25% levies on all exports to the US– made effective March 4th– are expected to cripple derived construction demand in Mexico. Long term, there could be benefits as the retainment of high skilled labour and Mexico’s foothold in changing global trade could foster more resilient growth, striding away from US dependence.

A tariff seesaw

Since Trump’s inauguration on January 20th, the White House announced a slew of tariffs on the US’s largest trading partners, biased to nations holding significant trade surpluses to the US. Seemingly, US tariffs are being threatened to further national interests, seeking to maximise rent on goods imported to the US, while leveraging access to the US’s market as a bargaining tool. Exact levy figures – and market ramifications – continue to fluctuate parallel Trump’s sporadic remarks, but to-date (29/05/2025):

- Mexico faces a 25% bilateral tariff on all USMCA non-compliant exports to the US, made effective March 4th, revoking USMCA free trade terms (consistent with Canada).

- Mexico is subject to 25% blanket automotive, steel and aluminum tariffs on all exports to the US, whereby steel and aluminum levies hit markets on March 12th, and automotive on April 3rd.

Mexico was exempt from further ‘Liberation Day’ tariffs (along with Canada) announced April 2nd, testament to President Claudia Sheinbaum’s cooperative stance as she has avoided retaliation. For example, as part of Mexico’s 30-day suspension on US tariffs in February, Mexico agreed to deploy 10,000 National Guard troops to its northern border to combat fentanyl trafficking and illegal immigration. It shows the US is open to trade political concessions for reprieves in the ongoing trade war.

For Latin America, while constant policy u-turns make forecasting difficult, the most obvious political concession appears to be cooperating in curtailing migration to the US, one of the Trump administration’s defining issues. Hence, the ability to leverage migration control in the tariff tit-for-tat means the likes of Mexico, Brazil, Argentina and other countries south of the US border face comparatively softer treatment. While China, on the other hand, faces an accumulated surtax of 145% in tariffs.

Short-term pain

Despite relatively subdued tariff measures, in the short-term, levies will abet waning export demand given the scale of US-Mexican trade.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

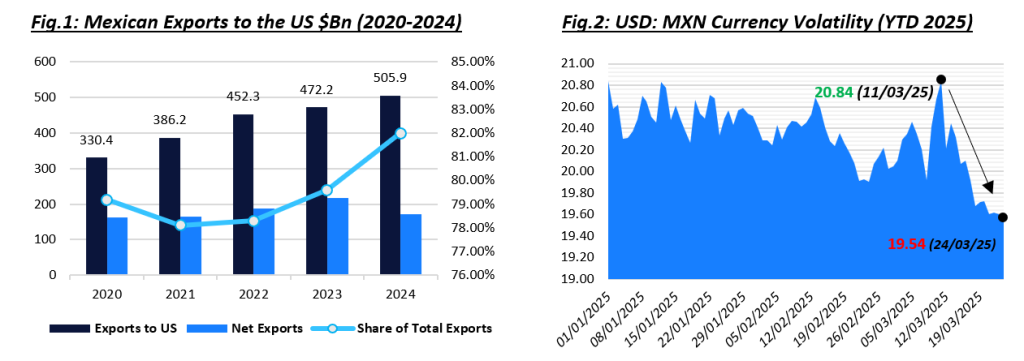

Evidently, Mexican exports to the US have been growing YoY to £505.9b in 2024. Similarly, US export share has increased to approximately 82% in 2024, indicative of how dependent Mexico had become on US trade. Therefore, tariffs will disproportionally weigh on Mexico’s economy as exporters scramble to substitute US demand.

Additionally, FX volatility has been adding to bearish sentiment, albeit recently, the US dollar has dramatically depreciated against the Mexican Peso, from 20.84 (March 11th) to 19.54 (March 24th)– as illustrated in Figure 2. Therefore, peso price appreciations will somewhat soften the blow to Mexican traders as their currency becomes more regionally competitive. Still, this boost in value will not be substantive enough to counter the expected loss in demand from US levies.

Previously, GlobalData argued that tariffs on Mexico would almost inevitably be inflationary, as higher import costs would translate into elevated building material prices and higher barriers to obtaining new building permits which would stunt construction output. However, it now seems that the inflationary effects from the tariffs are being outweighed by the deflationary effects of waning demand as trade volumes plummet.

Effectively, the higher prices Mexican constructors would hypothetically have to pay on the supply-side are currently redundant, because there isn’t sufficient demand to action the project. Regardless, the short-term net effect is negative. Therefore, GlobalData has revised Mexico’s construction output forecast to decline by 7% in 2025. Similarly, economic growth forecasts from TSLombard have been revised downwards from 0.5% to 0.2% for 2025.

(Not so) long term gain

Parallel to ongoing US-Mexican negotiations over trade in goods and services, Mexican migration to the US is expected to drop as the administration revamps deportation efforts, which have been an effective deterrent for would-be migrants. Given that US remittances to Mexico totalled approximately $65bn in 2024, mass deportations will compound short-term pain. However, the retention of skilled labour in Mexico, previously lost to US industries, could foster more resilient, long-term growth.

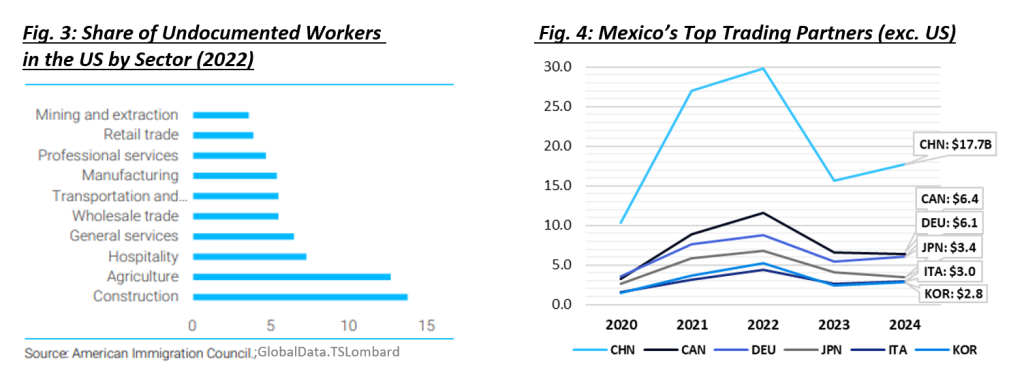

Figure 3 showcases that in 2022, undocumented workers accounted for approximately 14% of the US’s total construction workforce. It is a figure that likely increased in parallel with record surges in migration under the Biden-Harris administration. According to CPWR, workers of Mexican origin account for approximately one-third of the US’s total construction labour (2023). Therefore, Trump’s hostile migratory policies will inadvertently redirect construction labourers back to Mexico, increasing the ability of Mexican construction to source skilled labour.

Mexico’s capacity to capitalise on a more robust labour force, however, hinges on its ability to foster the public-private sectors to generate funds to stimulate construction jobs and growth. As previously mentioned, decreased US-Mexican trade will infringe this ability, but long-term, Mexico is taking steps to attract a more diverse assortment of investors.

For instance, all trade partners listed in Figure 4 face US levies of varying levels– and correspondingly pose a substitutable investment, particularly in China. Mexico also reached a revamped trade deal with the European Union in January, is currently discussing trade opportunities with China, and is reportedly exploring closer relations with Mercosur– Latin America’s regional trade block. GlobalData forecasts rebounded (albeit modest) construction growth in Mexico at a 2% CAGR from 206 to 2029.