The Caribbean real estate market is riding a high following a pandemic-induced buying spree that saw people turning to its sun and sandy beaches to escape Covid-19 lockdowns.

The islands see more than 300 days of sunshine each year; pristine beaches and warm water, coupled with the quiet of island life, have led many high-net-worth investors to buy property on the islands to live in, use as a vacation home or rent out to tourists.

The Caribbean hospitality financing survey 2022 found that 56% of non-banks (80% banks) believe the current real estate boom will last for the next 12 months and another 44% of non-banks (20% banks) think it will last considerably longer.

Liquidity remains high for many institutions, and they are turning to real estate as the best place to invest that cash.

“All our banking respondents expect it to be invested in real estate rather than in stock markets or held as cash and 75% of non-banks feel the same way,” the survey found.

The market looks steady, with no respondents saying they thought it was a bubble likely to burst.

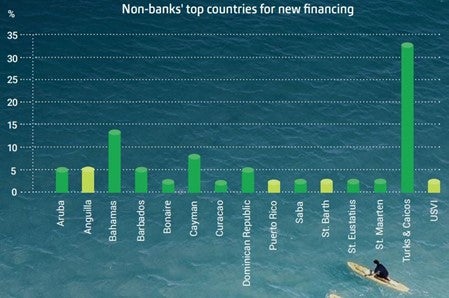

Within the Caribbean nations, banks are divided on where to invest, showing equal appetite across the 15 nations in the survey. However, for non-banks, one stood out: the Turks and Caicos Islands.

In the Turks and Caicos, the islands have seen sales increase to more than 324 transactions this year up to August, accounting for more than $335m in sales volume, according to real estate company The Agency. Demand for Turks and Caicos real estate remained higher than pre-pandemic levels, with a 71% increase in first-through-third quarter 2022 sales compared with the same time period in 2019.

“There has never been a better time to buy property in the Turks and Caicos,” says Walter Gardiner, a Turks and Caicos native and director and broker at Christie’s International Real Estate.

Sales on the island boomed during Covid-19 as buyers, mainly from the US, flocked to the islands; 85% of real estate owners on the islands are from North America, according to Sotheby’s.

Gardiner has worked in the Turks and Caicos real estate sector for 25 years. He has watched the islands rapidly transform from being a relatively unknown destination to a world-renowned luxury tourism hotspot, marked by a fast-growing luxury real estate market – and the pace isn’t set to slow soon.

In some places the infrastructure hasn’t kept up with how rapidly the islands have developed, and infrastructure development has now become a top priority. A new international terminal at the Providenciales International Airport should relieve some of the high wait times visitors may reckon with, and causeways between islands are being contemplated to make moving around the islands easier.

Gardiner says that some areas like Long Bay, which were previously untouched, have now exploded.

“Even 15 years ago, very few people bought properties over [on Long Bay] because it was [perceived as] far away, and the road wasn’t paved, but now if you go there, it is one of the highest-end places in the islands,” he says. “You have homes over there ranging from $7m to $25m on the beach.”

Meanwhile, over on North Caicos, which is less developed, properties may sell for just half a million dollars. According to Sotheby’s, buyers focused on single family villas in 2021 until the inventory depleted, and now, in 2022, buyers are focused on condominiums.

The pandemic boom has meant that demand has outpaced supply in some corners of the market, but new properties are being developed and sales of existing inventory remain strong. The pre-construction market is now picking up too.

“Condominium sales continue to be strong with a sales volume increase of 42.54%, led by the Rock House completion, Ritz Carlton sales completions carry-over and robust condominium re-sales,” the Sotheby’s second quarter report on Turks and Caicos real estate found.

Condos, either bought by people intending to live in them, use them as a vacation home or rent them out, have always been the backbone of the country’s real estate sector.

The Agency finds that condo prices remain strong, with the average sale price exceeding $1.5m, 50% greater than the national sale average, buoyed by sales at the Palms, Grace Bay Club and the Ritz Carlton.

Turks and Caicos is the second most tourism-dependent economy in the world, but the real estate sector offers a strong prospect for economic development.

“I want to see more Turks islanders take advantage of the opportunities,” Gardiner says. “There are opportunities for locals to benefit from by launching businesses that can service the needs of those buying property.”

Even as economic issues and concerns of rising costs grip individuals everywhere, the islands aren’t stopping.

“In terms of building prices, I have encouraged buyers to go ahead and build now because prices will only continue to go up everywhere,” says Trevor Musgrove, managing partner at real estate company The Agency T&C and president of the Turks & Caicos Hotel and Tourism Association.

Reiterating that now is the time to buy, Gardiner says: “We have passed various levels of stress tests, from political issues to hurricanes to Covid-19, we have faced all those challenges and made the necessary adjustments.”

Because of the dedication to infrastructure development and diversifying and expanding the real estate options on the islands, the future is bright for the industry in the Turks and Caicos – much like the sun that shines on the islands’ pristine beaches.

For more on how the Turks and Caicos is diversifying its economy and expanding its real estate sector, download the whitepaper here.