China’s clean technology investment overseas has reached approximately $80bn over the past year, according to a report by Australian research group Climate Energy Finance (CEF).

According to the report, Chinese companies have been seeking new markets to address a surplus in supply, resulting in a significant increase in foreign direct investment in green technology since early 2023.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The CEF report noted that since the start of 2023, China’s total overseas direct investment in clean technology has surpassed $180bn.

This expansion has been partly driven by countries seeking to strengthen clean tech cooperation with China, particularly following tariffs imposed by US President Donald Trump.

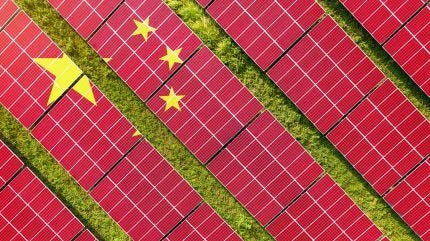

Chinese companies have established a strong presence in supply chains for critical minerals processing, solar panels and batteries.

Chinese foreign investment in clean energy infrastructure is also facilitating the creation of new markets for these products.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCEF China engagement lead and report author Caroline Wang noted that this trend offers opportunities for emerging economies aiming to decrease their reliance on imported fossil fuels.

Wang said: “China’s got a supply glut when it comes to green technology like solar panels and batteries, because of a structural supply-demand mismatch, so they need overseas markets to absorb their products,” according to Reuters.

According to the report, South East Asia continues to be the primary destination for Chinese clean technology manufacturing investments.

While new solar manufacturing investments in the region have declined due to US tariffs, Chinese investment in electric vehicles, renewable power and batteries has increased.

At the same time, the Middle East and North Africa became the most rapidly growing region for Chinese clean technology investment, led by Egypt, Morocco, Oman and Saudi Arabia.

Together, these countries secured approximately $7bn in announced funding. These projects highlight how Gulf and north African nations are pursuing economic diversification by developing sectors beyond oil.

The report found that Chinese companies are increasingly favouring large-scale projects that integrate both upstream and downstream supply chains.

Notable recent projects include an $8.27bn green hydrogen project in Nigeria announced by Longi Green Energy and a $6bn battery factory under construction by CATL in Indonesia.

The report noted that the October 2024–25 period marked the consolidation of China’s position as a “dominant global investor in clean-energy manufacturing and infrastructure”.

During this time, nearly $80bn in new projects were disclosed across 26 nations, primarily driven by private companies.

According to the report, Chinese companies view the trade war initiated by US President Trump in March 2025 as having increased uncertainty and have responded by prioritising “long-term risk mitigation through market diversification, with a focus on countries not hit by Trump’s tariffs that offer favourable investment environments”.

The Chinese Government has encouraged companies to collaborate with local companies in Belt and Road Initiative (BRI) nations.

The report read: “The clean-tech economy represents a flourishing form of South-South cooperation, where national development goals meet China’s techno-industrial might.

“While the US sees China’s rise as a threat, many developing countries are inspired by its success and aim to emulate it.”

According to statistics from the Chinese Ministry of Commerce “Going Global” Service Platform, Chinese enterprises made 215bn yuan in non-financial direct investment in BRI nations from January to September 2025, a 24.7% year-on-year increase.

Meanwhile, following Trump’s election, the US Administration has reduced its climate and clean energy commitments, increasing support for fossil fuels.

Most clean-energy production tax credits under the Inflation Reduction Act (IRA) have been suspended or reduced, and new renewable energy investment in the US fell by 36% in the first half of this year.

Many global companies, including First Solar and Enphase, have paused or relocated projects to South East Asia and the EU, the report noted.

The US President has committed to increasing oil and gas drilling, exiting the Paris Climate Agreement and reversing environmental policies established by previous administrations.

“Drill, baby, drill” was Trump’s campaign pledge, and the administration has proposed widening the production of fossil fuels.

The Trump administration has proposed opening federal waters near the coasts of Alaska, Florida and California for oil and gas drilling, including regions that have not previously been explored.

While other Western countries are taking steps to reduce reliance on fossil fuels, the US is moving in the opposite direction.