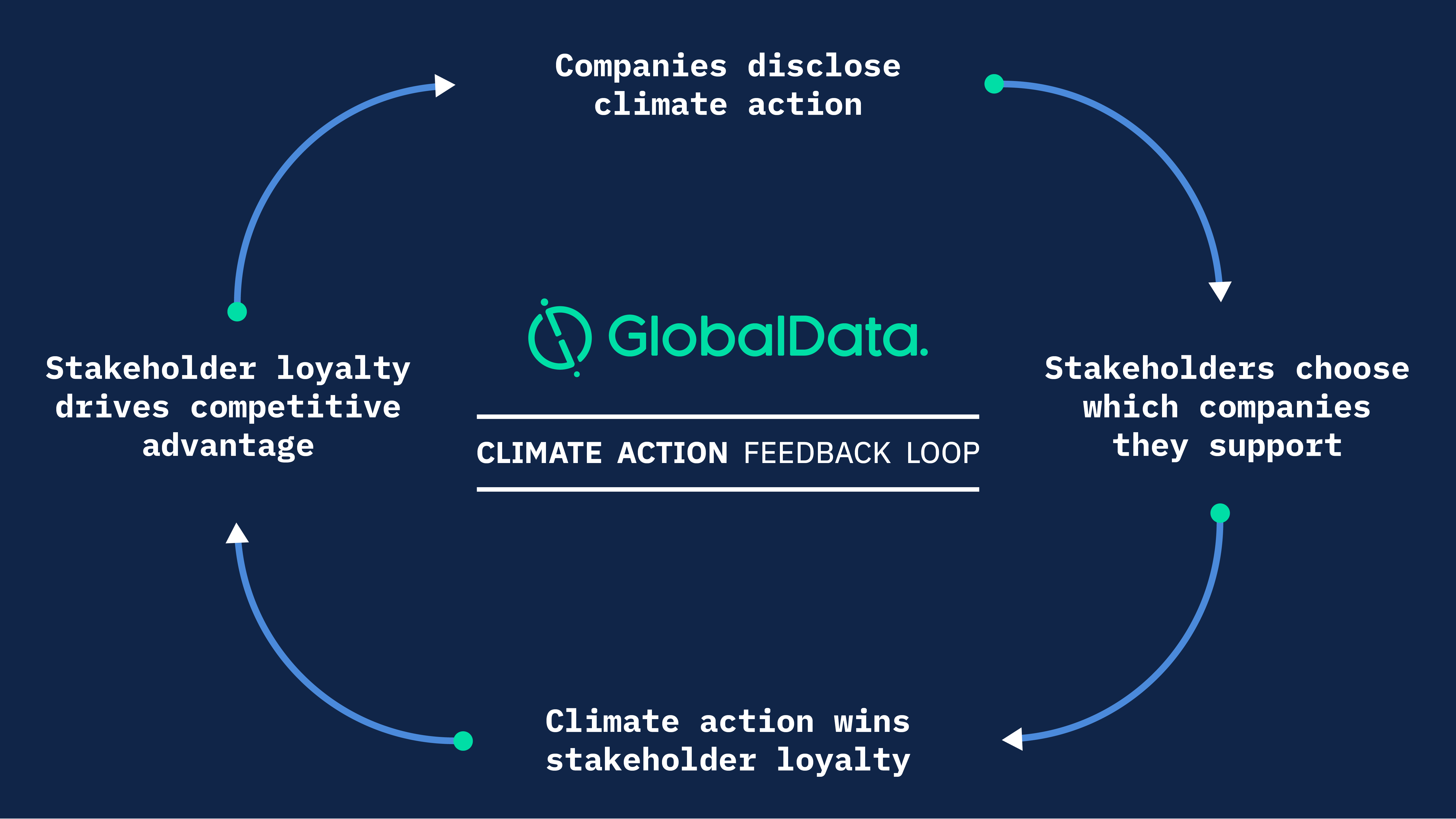

Although government action has been insufficient when it comes to putting the global economy on a path to net-zero carbon, market mechanisms are emerging that promise to drive major progress. We call this the climate action feedback loop. It is a cycle in which companies take action on climate and win stakeholder approval (for example, from customers, partners, employees and investors) that drives reputational and competitive advantage, and thus are incentivised to take further action.

For decades, the reigning philosophy of business management was that promulgated by economist Milton Friedman, who favoured free-market principles and minimal regulation. Friedman argued that corporations were solely responsible to their shareholders and bore no responsibility for anything else, including pollution or environmental harm. This view was never universal, but it held great sway among corporate managers even as environmental awareness grew and governments adopted environmental protections.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Awareness of climate change grew steadily, aided by landmark Congressional testimony in 1988 from researcher James Hansen (then with NASA), and by former US Vice-President Al Gore’s campaign to educate the public about global warming, which centred upon his 2006 documentary An Inconvenient Truth. Another inflection point came in August 2019, when the influential Business Roundtable in the US redefined the purpose of a corporation, saying that businesses should promote “an economy that serves all Americans” – including customers, employees, suppliers and communities, not just shareholders.

Interlocking forces create the climate action feedback loop

Our climate action feedback loop contains four interlocking factors:

- First, stakeholder activism is driving corporations to operate more transparently than in the past.

- Second, stakeholders increasingly vote with their wallets to support businesses that act responsibly on climate (and other matters of public concern).

- Third, businesses that act responsibly on climate will gain reputational and competitive advantage, encouraging more companies to take similar action.

- Fourth, over time, climate action will lead to many more net-zero choices for stakeholders, which will drive further climate action.

Corporate disclosure is not uniform, but it is far more extensive than it has ever been. Over the past few decades there has been a sustained effort to force greater disclosure of climate-related information and persuade companies that disclosure is in their best interest. The Global Reporting Initiative was launched in 1997, the Carbon Disclosure Project in 2000. Many other initiatives have been launched since then. In addition, a new age of accountability may be at hand. An initiative called Climate Trace, spearheaded by Gore, aims to use satellites and artificial intelligence to provide real-time, detailed visibility of pollution around the globe.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAll of this is helping stakeholders become more aware than ever and allowing them to assess companies’ performance on climate alongside their financials. Both institutional and individual investors increasingly use climate information (and sustainability more broadly) to guide their decisions and align their investments with their social and environmental goals. These trends seem certain to accelerate as awareness grows of business disruption from climate change. Financial analyses such as the one by Swiss Re, or the reports of First Street Foundation on the extent of property value erosion due to increased coastal flooding, are increasingly numerous and increasingly compelling.

The correlation between climate action, stakeholder loyalty and, ultimately, business results is nascent, but environmental concerns have been driving consumer behaviour – and supplier response – for decades. For proof, look no further than the number of ‘eco-friendly’ products on store shelves. ‘Climate-friendly’ is a newer category, but it is growing rapidly. Indeed, automakers, Amazon and many other companies have begun catering directly to consumers seeking to factor climate into their purchasing decisions.

Though not yet mature, the feedback loop is working

The climate action feedback loop is not mature. One sign of this lack of maturity is that reporting is still too complex. Another is that disclosure and transparency are not universal or standardised. Greenwashing remains too common, although consumers are becoming more sophisticated and pushing back. Yet another is the lack of accountability mechanisms in major net-zero initiatives.

Most important is that too few companies are participating. There have not yet been enough net-zero pledges and commitments to put the global economy on course to reach net zero by 2050.

To bolster and accelerate the feedback loop, regulation is needed to set standards and limits – for example, on methane emissions – and provide clear competition rules, as it did in driving the fuel efficiency standards that set the stage for electric vehicles. Then again, the feedback loop might prove to be more flexible and responsive than regulation. For example, asset managers such as BlackRock can, without waiting for regulators, ratchet up the stringency of the climate plans they require of their portfolio companies.

In any case, the climate action feedback loop is clearly starting to work. The Science-Based Targets initiative (SBTi) – a collaborative effort launched in 2015 by CDP (formerly the Carbon Disclosure Project), the UN Global Compact (UNGC), the World Resources Institute and the World Wide Fund for Nature – has won the participation of more than 1,400 companies that together represent 20% of global market capitalisation and has approved targets for more than 717 companies across all economic sectors. The SBTi’s analysis of 338 of these companies found they had reduced their greenhouse gas emissions by 25% between 2015 and 2019.

This is hugely important in three distinct ways. First, we know this because SBTi companies have promised to disclose their progress and kept those promises. Second, it demonstrates that significant and rapid emissions reductions are achievable with currently available technologies, even in today’s fractured and incomplete regulatory scene. Third, it sets the stage for stakeholders to make informed choices about which businesses they wish to support – choices that will ultimately affect those businesses’ financial results and lead more businesses to make climate-positive decisions. The power of the feedback loop is also evident in the accelerating pace of commitments to the SBTi and the Climate Pledge.

These are not the only significant initiatives. Another UN-backed campaign called Race to Zero brings together private and public actors that commit to halving greenhouse gas emissions by 2030 to achieve net zero by 2050 at the latest. Race to Zero has rallied support from 23 regions, 708 cities, 2,162 companies, 571 universities and 127 investors through several initiatives, including the Climate Pledge and the UNGC/SBTi Business Ambition for 1.5°C.

All are in their early stages. Many thousands of companies are working to build climate strategies, most of them still not fully formed. Ford recently announced it would bring an electric version of its bestselling F-150 pickup truck, the most popular motor vehicle of all time, to market in February 2022. It is saying this conservative market segment is ready to embrace a big climate-friendly change. In seven days, Ford reported 70,000 pre-orders, and its stock jumped 8%.

There is every reason to think that the forces driving the feedback loop will only gather strength. Relatively soon – in a matter of years, not decades – stakeholders will have multiple options for net-zero companies for the products and services they need. Steadily, and with growing speed, markets are figuring out how to address climate change.

This article is an extract from Climate Change, the latest in a series of ESG thematic reports from GlobalData.

Access the full report here.