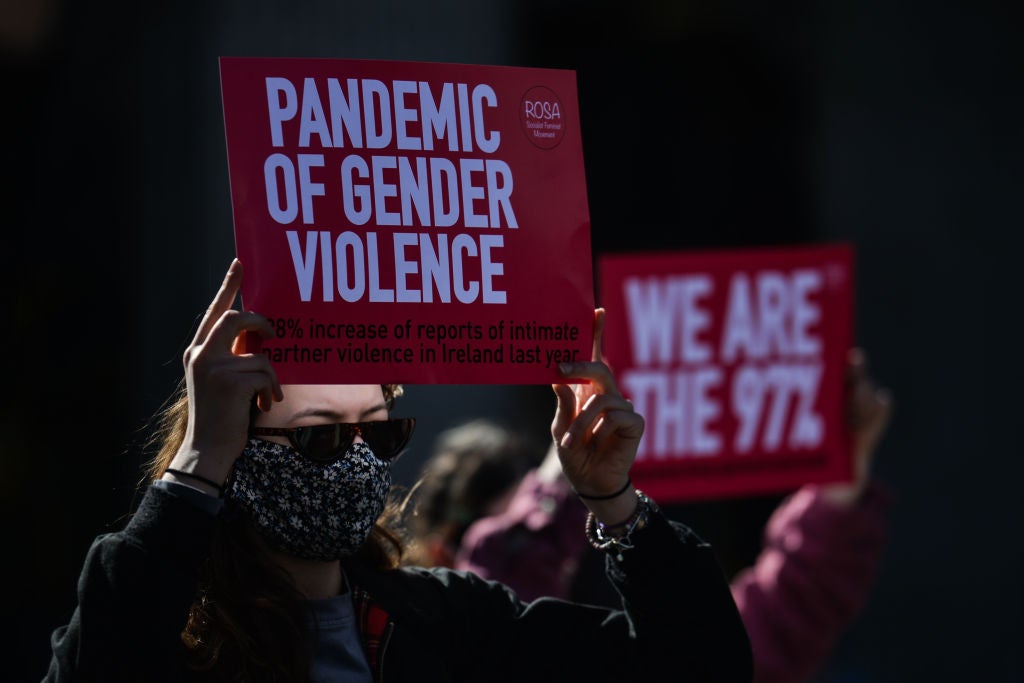

Tackling gender-based violence (GBV) is an important issue all over the world, but it is not a topic that many would automatically link with foreign direct investment (FDI). However, contributing towards an end to GBV should be at the forefront of investors’ agendas, particularly given the way that the Covid-19 pandemic has led to an increase in domestic and sexual violence, child marriage and abuse, possibly as a result of economic hardships many have felt over the past two years, along with the difficulties caused by school closures.

However, the problem of GBV dates back to long before the pandemic. Data from the World Health Organisation (WHO) shows that one in three women “are subjected to physical or sexual violence by an intimate partner or sexual violence from a non-partner, a number that has remained largely unchanged over the past decade”.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Simon McKenzie, managing director for Asia-Pacific at management consultancy Bridge Partnership, explains that GBV occurs where there is inequality rooted in a patriarchy, and where there is a culture of violence as the norm. “It is a global phenomenon, and a significant [issue] in all societies,” he says.

GBV exists in every country and culture, with OECD data revealing that the ten countries with the worst problems when it comes to prevalence of women who experience violence in their lifetime are Pakistan, Guinea, Senegal, Benin, Yemen, Iran, Bolivia, Fiji, Lesotho and Afghanistan.

How can FDI be a tool to battle GBV?

When it comes to the role FDI can play in tackling the issue of GBV on a global level, Catherine Leila Poulton, manager, gender-based violence in emergencies, at Unicef, says: “The relationship between GBV and systems of finance/investments is a two-way street. GBV poses both market and specific investment risks at the operational, political and regulatory levels, and thus needs to be a core part of investment decision-making. At the other end, investors yield power that can impact GBV, both within their own operations as well as in the environment in which they invest."

“FDI contributes to national economic development and can increase government revenue," adds Helene Papper, international GBV activist and director of global communications and advocacy at the International Fund for Agricultural Development (IFAD). "If earmarked specifically to address GBV it can have a significant impact. A reinvestment of this extra revenue in public facilities and infrastructures to increase formal labour opportunities for women, thus enabling them to have the necessary financial independence to say no to violence, is one way FDI can be efficient.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDue to the new jobs created through FDI projects, women are often presented with better employment opportunities, through both skilled and unskilled jobs. This increases their financial independence, which in turn can potentially give women the means to walk away from violent situations. Without these jobs, a woman's financial dependence on her husband or partner could mean she would face poverty if she were to remove herself from the relationship.

McKenzie suggests that there are several ways businesses and investors can make a difference in combatting GBV. Such ways include achieving gender equality at board level and throughout the organisation, ensuring there is no slavery or child labour in the supply chains the company uses, and recruiting survivors of trafficking and child marriage and bringing them into recruitment and talent programmes.

Other initiatives that companies could take when embarking on foreign investment include working with schools and communities to ensure girls are given equal educational opportunities to boys, investing in local businesses that help alleviate poverty within their countries of operation, and paying decent living wages to all staff.

Favour Adams, a GBV advisor at international development organisation Chemonics International, adds that FDI and the investment world more generally could tackle GBV through actionable commitments such as financing female-owned start-ups, as this would support the empowerment of women and give them greater independence.

The role of FDI in achieving SDG5

GBV is not only a human rights violation, it is also a public health challenge and a barrier to sustainable development and peace. This is why many are calling upon the private and the public sector to join forces and back investments that embrace environmental, social and corporate governance and the achievement of the UN's Sustainable Development Goals (SDGs), in a bid to boost women’s welfare, promote gender equality and tackle GBV.

However, there is a recognition that a holistic approach is needed in order to achieve this. Papper explains that FDI should be earmarked to support judiciary reform processes, and the development of a gender-sensitive approach to policymaking. “Women who denounce violence still face extreme risks of repercussions," she says. "The rise in femicides linked to women reporting violence only underlines the lack of protection mechanisms set in place, and underlines the need to shift to survivor-centred justice, which requires significant investment.”

Also, the Covid-19 pandemic has had a negative effect on women, highlighting that SDG5, which concerns achieving gender equality and empowering women and girls, has a long way to go before hitting the targets set for 2030.

“We have seen a dramatic increase in inequalities across the world over the past few years as a result of the pandemic," says Gareth Presch, CEO of the World Health Innovation Summit. "FDI provides investors and stakeholders with the opportunity to address those inequalities while implementing SDG5, which focuses on gender equality.”

Women and younger girls are more at risk of falling into poverty, often because they lack their own source of income and assets, a situation exacerbated by the impact of Covid-19. FDI can help reverse any setbacks created by the pandemic by hiring and providing training to female employees, giving them the opportunity to gain technical skills and assisting them in adapting to changing work environments. All of this is key for female empowerment, financial inclusion and battling GBV – and foreign investors can be at the forefront of this battle.